Friday, December 15, 2006

Wednesday, December 06, 2006

Task of the raider

The task (of a bidder; raider ) is to identify asset that not used efficiently, acquire it, make it efficient, and than realise it at competitive price on the market.

Thursday, November 30, 2006

Sunday, November 26, 2006

Saturday, November 25, 2006

Stones roll by U2 for top-grossing tour ever

NASHVILLE (Billboard) - Though they'll surely live to fight another day, U2's brief stint holding the title of top-grossing tour ever is over. That distinction returns to the Rolling Stones, whose A Bigger Bang tour is now the top-grossing tour in history.

Full article from Yahoo! UK& Ireland

Full article from Yahoo! UK& Ireland

Bank of Georgia IPO to raise 83 million pounds

LONDON (Reuters) - Bank of Georgia said on Friday it expected to raise $160 million (83 million pounds) in a share flotation that will make it the first ever company from the former Soviet Union country to list in London. Full article from Reuters UK

Friday, November 24, 2006

We won't chop up Gazporn:)

Russia' President Vladimir Putin denies EU proposal to unbundle Gazprom's upstream and downstream operations -- exploration and production from transportation and distribution. Article from Yahoo! Finance UK

Thursday, November 23, 2006

Sunday, November 19, 2006

World's fastest economy could speed to trouble

Article from Yahoo! Finance UK&Ireland about robust speed of Azeibardjan economy caused oil price increase along with the launch of the pipeline through Turkey that opens country's oil export direct access to the Western markets (bypassing Russia)

Tuesday, November 14, 2006

Hertz IPO is latest private-equity flotation

NEW YORK (Reuters) - Less than a year after private equity funds bought Hertz Global Holdings Inc. (NYSE:HTZ), the world's largest car rental company is on track for one of the largest U.S. stock flotations of the year.

Private equity investors, whose appetite for acquisitions is fueling a surge in overall M&A activity, have been shortening the time between leveraged buyouts and the initial public offerings they often use to cash out on the deals.

Companies are also boosting offering sizes after paying themselves larger dividends and loading up with debt.

"When you have so much money in these deals, it increases the pressure to an enormous degree to get liquidity," said Tom Taulli, founder of InvestorOffering.com. "Investors are pushing for faster turnarounds and the deals are becoming flips as opposed to investments."

ML Global Private Equity Fund LP, an affiliate of Merrill Lynch (NYSE:MER), and buyout firms Carlyle Group and Clayton Dubilier & Rice bought Hertz from Ford Motor Co. (NYSE:F) last December for $5.6 billion, or $15 billion including debt.

Park Ridge, New Jersey-based Hertz, which also has one of the largest equipment rental businesses in the United States, is scheduled to float about 88 million shares on Wednesday, or about 27.5 percent of the company, according to a prospectus filed with the Securities and Exchange Commission.

COULD BE NO. 2 U.S. IPO

The company could raise more than $1.8 billion if the shares price at the top of a $16 to $18 forecast range and over-allotment options are exercised. The company would also be valued at about $5.8 billion.

At an $18 share price, Hertz would be the No. 2 U.S. IPO this year after the $2.6 billion float of credit card association MasterCard (NYSE:MA ).

At that price, Hertz would trade at 57 times annualized earnings, based on current earnings, which are depressed by debt service payments, according to Francis Gaskins president of IPO Desktop, a research firm based in Marina del Rey, California.

Actual earnings would be higher once the IPO proceeds are used to pay down debt, making for a smaller price-earnings ratio.

Still, Hertz's valuation looks lofty compared with rivals Dollar Thrifty Automotive Group Inc. (NYSE:DTG ) and Avis Budget Group, Inc. (NYSE:CAR ), which trade at about 17 and 16 times earnings respectively, according to Reuters Estimates.

The Hertz investors are set to reap a paper gain of nearly $4 billion on $2.3 billion they invested less than a year ago.

The three firms will also receive a special dividend of up to $642 million from Hertz if the deal prices at the midpoint of the range and the underwriters exercise their option to sell 13 million additional shares.

In June, the investors used a $1 billion loan and cash on hand to pay a $999.2 million dividend to current stockholders.

Source Yahoo! Finance

Private equity investors, whose appetite for acquisitions is fueling a surge in overall M&A activity, have been shortening the time between leveraged buyouts and the initial public offerings they often use to cash out on the deals.

Companies are also boosting offering sizes after paying themselves larger dividends and loading up with debt.

"When you have so much money in these deals, it increases the pressure to an enormous degree to get liquidity," said Tom Taulli, founder of InvestorOffering.com. "Investors are pushing for faster turnarounds and the deals are becoming flips as opposed to investments."

ML Global Private Equity Fund LP, an affiliate of Merrill Lynch (NYSE:MER), and buyout firms Carlyle Group and Clayton Dubilier & Rice bought Hertz from Ford Motor Co. (NYSE:F) last December for $5.6 billion, or $15 billion including debt.

Park Ridge, New Jersey-based Hertz, which also has one of the largest equipment rental businesses in the United States, is scheduled to float about 88 million shares on Wednesday, or about 27.5 percent of the company, according to a prospectus filed with the Securities and Exchange Commission.

COULD BE NO. 2 U.S. IPO

The company could raise more than $1.8 billion if the shares price at the top of a $16 to $18 forecast range and over-allotment options are exercised. The company would also be valued at about $5.8 billion.

At an $18 share price, Hertz would be the No. 2 U.S. IPO this year after the $2.6 billion float of credit card association MasterCard (NYSE:MA ).

At that price, Hertz would trade at 57 times annualized earnings, based on current earnings, which are depressed by debt service payments, according to Francis Gaskins president of IPO Desktop, a research firm based in Marina del Rey, California.

Actual earnings would be higher once the IPO proceeds are used to pay down debt, making for a smaller price-earnings ratio.

Still, Hertz's valuation looks lofty compared with rivals Dollar Thrifty Automotive Group Inc. (NYSE:DTG ) and Avis Budget Group, Inc. (NYSE:CAR ), which trade at about 17 and 16 times earnings respectively, according to Reuters Estimates.

The Hertz investors are set to reap a paper gain of nearly $4 billion on $2.3 billion they invested less than a year ago.

The three firms will also receive a special dividend of up to $642 million from Hertz if the deal prices at the midpoint of the range and the underwriters exercise their option to sell 13 million additional shares.

In June, the investors used a $1 billion loan and cash on hand to pay a $999.2 million dividend to current stockholders.

Source Yahoo! Finance

Sunday, November 12, 2006

accounting information

The objective of accounting information is to enable decision makers to improve the allocation of resources which they control and to assess the actual results of their decisions against forecasted results.

Tuesday, October 10, 2006

Emerging markets drive forex reserves

Very comprehensive commentary on the current state of Forex markets and relationship between currencies of BRIC (Brazil, Russia, India, China) countries, their holding in dollar denominated assets. Full text on Forexblog

Money managers bet on cheap mining stocks

By Pratima Desai

LONDON (Reuters) - Fund managers are piling into mining stocks because they are cheap and do not reflect the strength of metals prices that by historical standards are still very high.

Copper, which accounts for almost 30 percent of British miners' earnings, jumped by nearly 85 percent to $8,800 a tonne between August 2002 and May this year.

Prices have fallen since May, but most of the gains bar about 17 percent are still intact.

The sell-off was precipitated by fears of a U.S.-led global economic slowdown, rising inflationary pressure and significantly higher interest rates around the world.

Share prices of leading British miners shot up by an average of around 70 percent between August 2002 and May this year, since when they have tumbled by nearly 20 percent.

"The sell-off ... is really overdone. The fundamentals really haven't changed substantially," said Aljoscha Haesen, senior analyst at British fund manager Forsyth Partners.

"The (fund) managers are taking advantage of these sell-offs in equity prices and are buying quality companies at valuations that are still very compelling."

The market's failure to appreciate the value of natural resource companies is why private equity funds which rarely foray into mining are scouting the sector, managers say

Source Reuters

LONDON (Reuters) - Fund managers are piling into mining stocks because they are cheap and do not reflect the strength of metals prices that by historical standards are still very high.

Copper, which accounts for almost 30 percent of British miners' earnings, jumped by nearly 85 percent to $8,800 a tonne between August 2002 and May this year.

Prices have fallen since May, but most of the gains bar about 17 percent are still intact.

The sell-off was precipitated by fears of a U.S.-led global economic slowdown, rising inflationary pressure and significantly higher interest rates around the world.

Share prices of leading British miners shot up by an average of around 70 percent between August 2002 and May this year, since when they have tumbled by nearly 20 percent.

"The sell-off ... is really overdone. The fundamentals really haven't changed substantially," said Aljoscha Haesen, senior analyst at British fund manager Forsyth Partners.

"The (fund) managers are taking advantage of these sell-offs in equity prices and are buying quality companies at valuations that are still very compelling."

The market's failure to appreciate the value of natural resource companies is why private equity funds which rarely foray into mining are scouting the sector, managers say

Source Reuters

Thursday, October 05, 2006

Wednesday, October 04, 2006

CEO stands up for Vonage's prospects despite cable rivals

Vonage Chairman Jeffrey Citron Tuesday defended the Internet phone company's ill-fated public offering and dismissed claims that looming competition from cable companies has dimmed its prospects.

"We (cable companies and Vonage) can both grow nicely at the same time," Citron said in an interview at USA TODAY.

Vonage pioneered voice over Internet protocol service, or VoIP, which uses a regular phone and adapter to send phone calls over a broadband line. Vonage has about 2 million lines.

But the company, which went public at $17 a share in May, fell 13% the first day of trading, largely on fears of increasing competition from deeper-pocketed phone and cable giants.

Its stock closed Tuesday off more than 58% from its opening price. It's the second-worst IPO of the year, based on Monday closing prices, Renaissance Capital says.

Renaissance analyst James DeStefano says the IPO was dominated by short-term investors.

Full text on USA 2day

"We (cable companies and Vonage) can both grow nicely at the same time," Citron said in an interview at USA TODAY.

Vonage pioneered voice over Internet protocol service, or VoIP, which uses a regular phone and adapter to send phone calls over a broadband line. Vonage has about 2 million lines.

But the company, which went public at $17 a share in May, fell 13% the first day of trading, largely on fears of increasing competition from deeper-pocketed phone and cable giants.

Its stock closed Tuesday off more than 58% from its opening price. It's the second-worst IPO of the year, based on Monday closing prices, Renaissance Capital says.

Renaissance analyst James DeStefano says the IPO was dominated by short-term investors.

Full text on USA 2day

Keep your eyes on insiders

Investors hurt by the sharp slide in home-builder stocks might now wish they'd kept a closer eye on what industry executives were doing with their own holdings.

CEOs of three of the top eight U.S. home builders sold large amounts of stock last year and avoided some of the financial pain since the shares peaked, a review of regulatory filings for USA TODAY by Thomson Financial shows.

Such insider selling, even as the stocks were hitting highs and home builders were pumping out homes, underscores how executives are often the first to react to swift business changes, says Mark LoPresti of Thomson.

Executives often have much of their wealth tied up in their companies and are closely aware of shifts in their industry. They're acquainted not only with their business' health and outlook but also have an acute understanding of the value of their company's shares.

So concentrated selling, or buying, by insiders can be a cue for individual investors. "We don't know for sure what's in the hearts of insiders," LoPresti says. But in his opinion, "It was extreme activity."

Full text on USA 2day

CEOs of three of the top eight U.S. home builders sold large amounts of stock last year and avoided some of the financial pain since the shares peaked, a review of regulatory filings for USA TODAY by Thomson Financial shows.

Such insider selling, even as the stocks were hitting highs and home builders were pumping out homes, underscores how executives are often the first to react to swift business changes, says Mark LoPresti of Thomson.

Executives often have much of their wealth tied up in their companies and are closely aware of shifts in their industry. They're acquainted not only with their business' health and outlook but also have an acute understanding of the value of their company's shares.

So concentrated selling, or buying, by insiders can be a cue for individual investors. "We don't know for sure what's in the hearts of insiders," LoPresti says. But in his opinion, "It was extreme activity."

Full text on USA 2day

Canadian oil production may boost Loonie

Canada currently had enough oil reserves to supply all US oil needs for the next three years. The only problem is that much of this oil is trapped in Canada’s oil sands, and it may be costly and difficult to extract. Once the oil starts to flow, however, Canada will likely become one of the world’s top 10 oil exporters, behind such powerhouses as Venezuela, Russia, Saudi Arabia, and Iran. The recent strength of Canada’s currency, the Loonie, can be almost entirely attributed to the high price of commodities, especially oil. It seems forex traders would benefit from studying a little geology

Source Forexblog

Source Forexblog

Monday, October 02, 2006

Update -- Venezuela, Nigeria To Cut Oil Production

The decision by Venezuela and Nigeria to cut crude oil production will have little immediate impact on U.S. gasoline prices because storage tanks are filled to the brim, an oil analyst says.

Venezuela said on Friday it plans to cut crude oil production by about 50,000 barrels a day. On the same day, Nigeria said it plans to hold back about 120,000 barrels a day.

The cuts, scheduled to take place Oct. 1, are an apparent attempt to jack prices as demand falls.

The price of a barrel of oil has lost about 20% from its July peak of $78.40 on the New York Mercantile Exchange. On Friday, crude oil declined 1cent to $62.90 a barrel. The price for gasoline fell, but heating oil edged up about 3.5 cents. In London, Brent crude declined 6 cents to $62.48 a barrel.

Full text on Forbes.com

Venezuela said on Friday it plans to cut crude oil production by about 50,000 barrels a day. On the same day, Nigeria said it plans to hold back about 120,000 barrels a day.

The cuts, scheduled to take place Oct. 1, are an apparent attempt to jack prices as demand falls.

The price of a barrel of oil has lost about 20% from its July peak of $78.40 on the New York Mercantile Exchange. On Friday, crude oil declined 1cent to $62.90 a barrel. The price for gasoline fell, but heating oil edged up about 3.5 cents. In London, Brent crude declined 6 cents to $62.48 a barrel.

Full text on Forbes.com

Emerging Market currencies hurt by risk aversion

Forex markets punished emerging market currencies this week, due to heightened economic and political risk. Many traders had piled into carry trade positions, selling low-yielding, stable currencies in favor of higher-yielding, but more volatile currencies. After a string of negative political and economic developments, many traders unwound their positions and moved back into the more stable currencies. After all was said and done, the currencies of Turkey and South Africa had declined more than 3%, while those of Brazil and Mexico declined by almost 2%. However, analysts now feel the sudden drop was nothing more than a long overdue correction, and remain bullish on emerging markets. Daily News and Analysis Online reports:

Post that shake-out, high risk currencies enjoyed a strong rebound. Low interest rates encouraged speculators to re-enter carry trades and build up large speculative positions, going short on the Yen and Swiss Franc.

Source Forex blog

Post that shake-out, high risk currencies enjoyed a strong rebound. Low interest rates encouraged speculators to re-enter carry trades and build up large speculative positions, going short on the Yen and Swiss Franc.

Source Forex blog

Income tax cuts benefit all payers

Americans of every income have benefited from a drop in federal income tax rates as Bush administration tax cuts enacted since 2000 took effect, an independent analysis of newly released IRS data shows.

But those earning $75,000 to $500,000 are shouldering a larger share of total taxes paid as millions more of them earn higher incomes and get hit with the Alternative Minimum Tax, the analysis also found.

The review by the Tax Foundation, a non-partisan research group that favors low taxes, provides one of the first detailed looks at the impact of federal tax changes phased in between 2000 and 2004.

Alluding to the political debate that often surrounds tax issues, Gerald Prante, a Tax Foundation economist, said, "It is true that in dollar amounts the rich have gained the most. But everybody's tax rates have fallen."

Full article

But those earning $75,000 to $500,000 are shouldering a larger share of total taxes paid as millions more of them earn higher incomes and get hit with the Alternative Minimum Tax, the analysis also found.

The review by the Tax Foundation, a non-partisan research group that favors low taxes, provides one of the first detailed looks at the impact of federal tax changes phased in between 2000 and 2004.

Alluding to the political debate that often surrounds tax issues, Gerald Prante, a Tax Foundation economist, said, "It is true that in dollar amounts the rich have gained the most. But everybody's tax rates have fallen."

Full article

Thursday, September 28, 2006

House prices up sharply this month

LONDON (Reuters) - House prices jumped in September, the Nationwide Building Society said on Thursday, evidence that August's interest rate rise had done little to cool the property market.

The Nationwide said the cost of an average home rose 1.3 percent, bringing the annual rate of house price inflation to 8.2 percent -- its fastest rate since February 2005.

An average home cost 169,413 pounds in September, almost 13,000 pounds more than at the same time last year. Over the year, the typical home has risen in value by more than 35 pounds a day.

Full article from Reuters

The Nationwide said the cost of an average home rose 1.3 percent, bringing the annual rate of house price inflation to 8.2 percent -- its fastest rate since February 2005.

An average home cost 169,413 pounds in September, almost 13,000 pounds more than at the same time last year. Over the year, the typical home has risen in value by more than 35 pounds a day.

Full article from Reuters

EMI shares up on report of Warner bid

LONDON (Reuters) - Shares in EMI Group gained as much as 7.1 percent on Wednesday following a report that Warner Music Group was preparing a new bid to buy the world's third largest music company.

The Times, citing unnamed investors, said Warner Music's Chief Executive Edgar Bronfman had targeted the British group's shareholders and emphasised the benefits of a future tie-up during a visit to London earlier this month.

"He is not thought to have discussed a specific future bid for EMI," the report said.

Full article from Reuters

The Times, citing unnamed investors, said Warner Music's Chief Executive Edgar Bronfman had targeted the British group's shareholders and emphasised the benefits of a future tie-up during a visit to London earlier this month.

"He is not thought to have discussed a specific future bid for EMI," the report said.

Full article from Reuters

Wednesday, September 27, 2006

Dovish Blanchflower pushes sterling to 1-wk lows

LONDON, Sept 27 (Reuters) - Sterling fell to a one-week low versus the dollar and slid from recent peaks against the euro on Wednesday, after Bank of England policymaker David Blanchflower sounded a cautious note on the economy.

Sterling's losses were accentuated by downward revisions to second quarter economic growth and the GDP deflator.

Blanchflower said inflationary expectations had levelled off, the labour market looked set to weaken further and the economy may have more capacity than data have indicated.

BoE's Deputy Governor Sir John Gieve also sounded less hawkish than earlier in the week, warning on Tuesday that a November rate hike could not be taken for granted as any move would depend on how the economy developed.

Full article from Reuters

Sterling's losses were accentuated by downward revisions to second quarter economic growth and the GDP deflator.

Blanchflower said inflationary expectations had levelled off, the labour market looked set to weaken further and the economy may have more capacity than data have indicated.

BoE's Deputy Governor Sir John Gieve also sounded less hawkish than earlier in the week, warning on Tuesday that a November rate hike could not be taken for granted as any move would depend on how the economy developed.

Full article from Reuters

William Hill ends U.S. gaming on legal issues

LONDON (Reuters) - Bookmaker William Hill said on Wednesday it had stopped its gaming business in the United States, pending clarification of the scope and enforceability of state and federal gaming laws.

William Hill said it had taken steps to stop accepting casino and poker business from clients with a U.S. address or U.S.-issued credit card, the same as steps already in place to prevent Internet betting on sports events by U.S. residents.

This year has seen the arrests in the United States of Sportingbet's chairman on charges of "gambling by computer" and BETonSPORTS's then chief executive on racketeering charges.

Full article from Reuters

William Hill said it had taken steps to stop accepting casino and poker business from clients with a U.S. address or U.S.-issued credit card, the same as steps already in place to prevent Internet betting on sports events by U.S. residents.

This year has seen the arrests in the United States of Sportingbet's chairman on charges of "gambling by computer" and BETonSPORTS's then chief executive on racketeering charges.

Full article from Reuters

Labels:

bets,

bets online,

bookmaker,

bookmaking,

gambling,

issue,

legal,

reuters,

the US,

william hill

Growth turning point means crunch time for investors

LONDON (Reuters) - Investors who have been profiting from the most robust global economic growth in decades are suddenly being forced to decide whether it is all about to come to an end and if so how severely.

One result: Volatility has been, well, volatile.

The VIX and VDAX indexes -- which are measures of expected equity price swings over a period of time -- have been on a yo-yo string throughout September, indicating unusual strong uncertainty among investors.

What is happening is that investors have decided that they are at a turning point. But they are not sure whether it is a mid-cycle slowdown or a more robust end of cycle altogether

Full article from Reuters

One result: Volatility has been, well, volatile.

The VIX and VDAX indexes -- which are measures of expected equity price swings over a period of time -- have been on a yo-yo string throughout September, indicating unusual strong uncertainty among investors.

What is happening is that investors have decided that they are at a turning point. But they are not sure whether it is a mid-cycle slowdown or a more robust end of cycle altogether

Full article from Reuters

Labels:

bond,

equity,

fund,

growth,

investor,

price,

reuters,

uncertainty,

volatility

Tuesday, September 26, 2006

Inequality in wealth distribution: the causes

The principal causes of rising inequality, in America and much of the rest of the world, are rapid technological innovation and globalisation. These structural shifts, which have spawned enormous prosperity, are boosting the earnings of the most skilled and well-educated far faster than the rest.

Labels:

America,

globalisation,

inequality,

innovation,

the US

The Conference Board Consumer Confidence Index Posted a Gain in September

The Conference Board Consumer Confidence Index, which decreased sharply in August, posted a gain in September. The Index now stands at 104.5 (1985=100), up from 100.2 in August. The Present Situation Index increased to 127.7 from 123.9. The Expectations Index rose to 89.0 from 84.4 last month.

Full text on Conference-Board

Full text on Conference-Board

Dollar getting stronger against majors

The greenback edged up higher against the majors in the Tuesday session, albeit within the confines of the recent ranges. The dollar pushed the euro beneath the 1.27-level to a one-week low at 1.2663, while shooting up past the 117-mark versus the yen. Propping the currency higher was a respite in the stream of soft US economic data, following the release of an upbeat consumer confidence survey and Richmond Fed manufacturing survey.

More on Forexnews.com

More on Forexnews.com

The dark side of debt

The Economist's article about tendencies in modern debt markets and their concequences for the financial system as a whole

Labels:

debt,

economist,

finance,

financial markets,

financial system

Tiger Woods - the giant of marketing ROI

Quote from Forbes

"The gem cannot be polished without friction, nor man perfected without trials."

-Chinese proverb

-Chinese proverb

Donald Rumsfeld on US policy on the war on terror, 3/07/2003

"There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know and there things that we don't know. But there are also unknown unknowns. There are things we don't know we don't know."

-- Donald Rumsfeld, clarifying U.S. policy on the war on terror at a Pentagon briefing.

-- Donald Rumsfeld, clarifying U.S. policy on the war on terror at a Pentagon briefing.

Sunday, September 24, 2006

Friday, September 22, 2006

US dollar dips on dovish Fed statement

US dollar drifts against all major currencies after Federal Open Market Committee meeting. As was expected by the experts, the Fed kept US interest rates on hold at 5.25 per cent.

FT.com on Yahoo! Finance

FT.com on Yahoo! Finance

For how long Kiwi will be in demand?

The New Zealand Dollar, also known as Kiwi has appreciated 10% against US dollar. Analytics suppose this upward trand caused by yeld policy. Forex traders attracted by higher yelds thus drive the demand for Kiwi. Teh points, for how long this trend will last?

Full article Forex Bolg

Full article Forex Bolg

London slides as Philly Fed spooks Street

Stocks in London slides after weaker than expected Philly Fed data

Source FT.com on Yahoo! Finance

Source FT.com on Yahoo! Finance

Thursday, September 21, 2006

Chatting With China

China has long wanted to move discussions with the U.S. over the broad range of contentious trade and economic issues the U.S. has with it beyond the broad range of contentious trade and economic issues the U.S. has with it.

Full article from Forbes.com

Full article from Forbes.com

Wal-Mart:Quantity of Employees

Wal Mart is the biggest employer in the US, currently employing about 1.3 million workers, according to Forbes.com

Stocks Slide After Philly Fed Report

Stocks retreated Thursday after the Philadelphia Federal Reserve surprised Wall Street by announcing that its broadest measure of manufacturing activity fell to a negative reading for the first time since April 2003, renewing investor fears that the economy could be cooling too quickly.

Full article from Forbes

Full article from Forbes

Labels:

Bernanke,

economy,

fed,

federal reserve,

forbes,

investor,

stocks,

Wall Street

Wednesday, September 20, 2006

MPC decision to hold rates this month was unanimous

Monetary Policy Committee voted 8-0 for keeping the cost of pound sterling borrowing in unchanged after after the surprise quarter percentage point hike the month before. Current rate is 4.75%

Source FT.com on Yahoo! Finance

Source FT.com on Yahoo! Finance

Tuesday, September 19, 2006

Wall Street lower as investors mull housing data

Wall Street opened lower on Tuesday as a report showing a sharp fall in new housing starts offset lower-than-expected inflation data.

By mid-morning, the S&P 500 (news) was down 0.1 per cent or 0.96 points at 1,320.22, while the Nasdaq Composite (NASDAQ: news) was flat, down 0.71 points at 2,235.04.

The Dow Jones Industrial Average dropped 0.2 per cent or 17.53 points to 11,537.47.

Source FT.com on Yahoo! Finance

By mid-morning, the S&P 500 (news) was down 0.1 per cent or 0.96 points at 1,320.22, while the Nasdaq Composite (NASDAQ: news) was flat, down 0.71 points at 2,235.04.

The Dow Jones Industrial Average dropped 0.2 per cent or 17.53 points to 11,537.47.

Source FT.com on Yahoo! Finance

Labels:

finance,

financial times,

FT,

housing data,

Wall Street,

Yahoo

Quote from Forbes

"Never let your sense of morals prevent you from doing what is right."

-Isaac Asimov

-Isaac Asimov

Yen hits five-month low after G7 meeting

The yen slumped to a five-month low against the US dollar in European morning trade on Monday, shrugging off an apparently concerted attempt by central bankers to talk up the ailing Japanese currency.

Jean-Claude Trichet, the president of the European Central Bank, said in the aftermath of a G7 meeting in Singapore at the weekend that: “We noted that [Japan] had exited its zero rate policy, that its recovery is now broad based.

We agreed that the yen will reflect these developments.” Sadakazu Tanigaki, the Japanese finance minister, also argued that the value of the yen should reflect Japan’s recovering economy, adding that the recent fall in the currency had been a “little rough”.

The yen has tumbled 6.1 per cent against the euro since mid-May, hitting an all-time low against the single currency on 16 separate occasions.

However, after an initial jump higher when trading re-opened, the yen more than surrendered these gains to sit weaker than on Friday.

The yen initially spiked to Y148.10 against the euro, but fell back to Y149.59, Y0.7 weaker than Friday’s close.

Similarly the yen sat Y0.6 weaker at Y118.17 to the US dollar, its weakest level since April, having peaked at Y117.15.

The yen was also Y0.3 weaker at Y88.76 to the Australian dollar and Y0.6 lighter at Y221.62 against sterling.

Source FT.com on Yahoo! Finance

Jean-Claude Trichet, the president of the European Central Bank, said in the aftermath of a G7 meeting in Singapore at the weekend that: “We noted that [Japan] had exited its zero rate policy, that its recovery is now broad based.

We agreed that the yen will reflect these developments.” Sadakazu Tanigaki, the Japanese finance minister, also argued that the value of the yen should reflect Japan’s recovering economy, adding that the recent fall in the currency had been a “little rough”.

The yen has tumbled 6.1 per cent against the euro since mid-May, hitting an all-time low against the single currency on 16 separate occasions.

However, after an initial jump higher when trading re-opened, the yen more than surrendered these gains to sit weaker than on Friday.

The yen initially spiked to Y148.10 against the euro, but fell back to Y149.59, Y0.7 weaker than Friday’s close.

Similarly the yen sat Y0.6 weaker at Y118.17 to the US dollar, its weakest level since April, having peaked at Y117.15.

The yen was also Y0.3 weaker at Y88.76 to the Australian dollar and Y0.6 lighter at Y221.62 against sterling.

Source FT.com on Yahoo! Finance

Labels:

dollar,

finance,

financial times,

five-months low,

FT,

G7 meeting,

rate,

Yahoo,

yen

Monday, September 18, 2006

VOD2-new era of video

Two big on-line sellers (Apple and Amazon) both introduced VOD2 (Video On Download) service to their customers. Apple bets on speed of download, Amazon on quality. Who is wrong, who is right? Time will show.

Full article Does Big Beat Fast?

Full article Does Big Beat Fast?

Quote from Forbes

Obstacles are those frightful things you see when you take your eyes off the goal."

-Hannah More

-Hannah More

Sunday, September 17, 2006

Saturday, September 16, 2006

Quote from Forbes

"Experience and enthusiasm are two fine business attributes seldom found in one individual."

-William Feather

-William Feather

Labels:

attributes,

business,

enthusiasm,

experience,

forbes,

individual,

quote,

william feather

Tuesday, September 12, 2006

Saturday, September 09, 2006

Thought of day

"Act with a determination not to be turned aside by thoughts of the past and fears of the future."

-Robert E. Lee

-Robert E. Lee

Labels:

act,

day,

determination,

forbes,

quote,

Robert E. Lee,

thought

Saturday, August 26, 2006

Tuesday, August 15, 2006

Emerging market currencies face sell-off

Emerging markets have fared well this year, due to a combination of increased investor appetite for risk and strong fundamentals. Many emerging countries have also witnessed a rapid appreciation in their currencies, as foreigners pored money into direct and portfolio investments. As rates have risen in the developed world, however, many investors have begun to reevaluate the economics of such investments. In fact, the risk-return profile is changing to the extent that it may prove more efficient to invest money in lower-yielding, but safer American and European debt securities. The Financial Times reports:

“The market is only pricing in a 36 per cent chance of a rate rise in September…, so there is room for dollar upside, which would squeeze emerging markets.”

Source Forex blog

“The market is only pricing in a 36 per cent chance of a rate rise in September…, so there is room for dollar upside, which would squeeze emerging markets.”

Source Forex blog

Labels:

currency,

direct investment,

dollar,

emerging markets,

forex,

fundamental,

invest,

newspaper,

portfolio investment,

rate,

security,

sell off,

US debt

Monday, August 14, 2006

Commentary: USD driven by rate differentials

Over the past 6 months, the Euro and Pound Sterling have risen steadily in value against the USD. Labor and market reforms are forcing European companies to become more competitive. Hence, the economies of Britain and the EU are finally beginning to show signs of life. While economic fundamentals have certainly contributed to currency appreciation, they must take a back seat to interest rate differentials in any analysis of currency markets. Economists reason that interest rate differentials represent a leading indicator for foreigner’s willingness to continue financing the US current account deficit. That is, if US capital markets can continue to offer foreigners attractive returns, then they will continue to park their savings in the US.

In details from FOREX BLOG

In details from FOREX BLOG

Labels:

Britain,

capital markets,

currency,

current account,

deficit,

differentials,

EU,

euro,

forex,

fundamental,

market,

pound sterling,

rate,

US current account

Friday, August 11, 2006

Wednesday, August 09, 2006

Don't Bank On SPR - Forbes.com

WASHINGTON, D.C. -

Don't look to the Strategic Petroleum Reserve to ease surging oil prices after the shutdown of BP's pipeline in Prudhoe Bay: If history is any guide, any release from the SPR will be too little, too late. Or it might not come at all.

The 700-million-barrel stockpile sitting in salt caves along the Gulf Coast has been used only three times since it was created in the wake of the 1973 Arab oil embargo. And it is unclear whether it has ever successfully mitigated an oil price shock.

Not surprisingly, markets greeted with a yawn assurances by energy czar Samuel Bodman on Monday that he would come to the rescue in the event of an oil shortage. After closing at a near record in nominal terms of $76.98 the day before, prices edged off just slightly but remained above $76, as officials suggested that Prudhoe Bay's reserves might be offline until February.

There is no reason the SPR couldn't have a major impact during a price shock. Its drawdown capacity of 4 million barrels of oil per day is roughly equal to the amount Iran adds daily to the world oil supply. With the stockpile releasing at full tilt, the government would be able to replace over a third of oil imports and add about 5.9% to the world's daily oil supply for roughly 163 days before the reserve ran dry, according to a study last year by economists Jerry Taylor and Peter Van Doren of the libertarian Cato Institute.

The problem is the government's shoddy management of the reserves. It has tended to buy oil as prices are rising and then hoard it in a time of crisis.

"It's a policy of buying high and selling never," says Taylor.

Don't Bank On SPR - Forbes.com

Don't look to the Strategic Petroleum Reserve to ease surging oil prices after the shutdown of BP's pipeline in Prudhoe Bay: If history is any guide, any release from the SPR will be too little, too late. Or it might not come at all.

The 700-million-barrel stockpile sitting in salt caves along the Gulf Coast has been used only three times since it was created in the wake of the 1973 Arab oil embargo. And it is unclear whether it has ever successfully mitigated an oil price shock.

Not surprisingly, markets greeted with a yawn assurances by energy czar Samuel Bodman on Monday that he would come to the rescue in the event of an oil shortage. After closing at a near record in nominal terms of $76.98 the day before, prices edged off just slightly but remained above $76, as officials suggested that Prudhoe Bay's reserves might be offline until February.

There is no reason the SPR couldn't have a major impact during a price shock. Its drawdown capacity of 4 million barrels of oil per day is roughly equal to the amount Iran adds daily to the world oil supply. With the stockpile releasing at full tilt, the government would be able to replace over a third of oil imports and add about 5.9% to the world's daily oil supply for roughly 163 days before the reserve ran dry, according to a study last year by economists Jerry Taylor and Peter Van Doren of the libertarian Cato Institute.

The problem is the government's shoddy management of the reserves. It has tended to buy oil as prices are rising and then hoard it in a time of crisis.

"It's a policy of buying high and selling never," says Taylor.

Don't Bank On SPR - Forbes.com

Labels:

barrel,

BP,

British Petroleum,

crisis,

forbes,

management,

oil,

price,

Prudhoe Bay,

reserves,

SPR,

Strategic Petroleum Reserve Washington DC

Tuesday, August 08, 2006

Fed Takes A Breath - Forbes.com

The U.S. Federal Reserve held its key interest rate unchanged at 5.25% at its Open Market Committee meeting today, but left the door open for possible future increases.

Stocks moved lower on the news, as concern that the Fed may continue raising rates in the future seemed to trump the non-action this time around. The Dow was down 24 points, and the Nasdaq was off 7 points in late afternoon trading, reversing moderate gains earlier in the day.

In its accompanying statement, the central bank said that while inflation readings have been elevated in recent months, pressures "seem likely to moderate over time, reflecting contained inflation expectations and the cumulative effects of monetary policy actions and other factors restraining aggregate demand."

But while acknowledging continued risks of higher core inflation, which excludes volatile food and energy costs, the Fed repeated the mantra from its June meeting, asserting that "any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth."

Article in detail from Forbes.com

Stocks moved lower on the news, as concern that the Fed may continue raising rates in the future seemed to trump the non-action this time around. The Dow was down 24 points, and the Nasdaq was off 7 points in late afternoon trading, reversing moderate gains earlier in the day.

In its accompanying statement, the central bank said that while inflation readings have been elevated in recent months, pressures "seem likely to moderate over time, reflecting contained inflation expectations and the cumulative effects of monetary policy actions and other factors restraining aggregate demand."

But while acknowledging continued risks of higher core inflation, which excludes volatile food and energy costs, the Fed repeated the mantra from its June meeting, asserting that "any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth."

Article in detail from Forbes.com

Wednesday, August 02, 2006

Monday, July 31, 2006

Expectations govern markets. Only the media can make money from yesterday. Money is made in markets by people acting today in expectation of what will happen in the future, or in fulfillment of what had been expected and acted upon previously. Changing expectations change markets.

In details

In details

Sunday, July 30, 2006

Trade diplomacy and internal politics

The trade diplomat's incantation that to open his market is a “concession” granted in exchange for an opening somewhere else is economic nonsense spouted for domestic political purpose.

But it is remarkably fruitful nonsense because, within the World Trade Organisation, any concession to one trade partner is automatically extended to all members. This trick has helped the world enjoy decades of prosperity.

(Source The Economist)

But it is remarkably fruitful nonsense because, within the World Trade Organisation, any concession to one trade partner is automatically extended to all members. This trick has helped the world enjoy decades of prosperity.

(Source The Economist)

Supply concerns push oil and copper higher

Oil prices continued to rise on Friday, extending their gains from the previous session, amid continuing concerns about fighting in the Middle East and the possibility of prolonged disruption in to output from Nigeria.

In Nigeria, Shell has declared force majeure on Bonny Light crude exports from a terminal that normally exports about 390,000 barrels of oil a day after a pipeline leak shut down 180,00 barrels a day of production.

Shell’s chief executive warned there was unlikely to be a significant recovery this year in the production that has been shut down.

ICE September Brent rose 20 cents to $75.21 a barrel while Nymex September West Texas Intermediate added 10 cents to $74.64 a barrel.

Copper rose to $7,620 a tonne on supply concerns with workers at Escondida, the world’s largest copper mine in Chile, likely to vote for strike action later on Friday.

Click here for more from FT.com

Source Yahoo! Finance

In Nigeria, Shell has declared force majeure on Bonny Light crude exports from a terminal that normally exports about 390,000 barrels of oil a day after a pipeline leak shut down 180,00 barrels a day of production.

Shell’s chief executive warned there was unlikely to be a significant recovery this year in the production that has been shut down.

ICE September Brent rose 20 cents to $75.21 a barrel while Nymex September West Texas Intermediate added 10 cents to $74.64 a barrel.

Copper rose to $7,620 a tonne on supply concerns with workers at Escondida, the world’s largest copper mine in Chile, likely to vote for strike action later on Friday.

Click here for more from FT.com

Source Yahoo! Finance

Saturday, July 29, 2006

Friday, July 28, 2006

Where the wealth is?

The level of gross foreign claims on U.S. assets is approaching $14 trillion, about 25 percent of U.S. wealth and perhaps 10 percent of global wealth. Eventually, foreign investors would become reluctant to own, say, the bulk of U.S. assets or to have the majority of their wealth holdings invested in one country. However, we are far from such limits for two reasons.

Followign that logic, the USA is home for the 40% of global wealth.

Source - America's External Balances Economic outlook

'America, America, God shed his grace on thee,

And crown thy good with brotherhood,

From sea to shining sea...'

Followign that logic, the USA is home for the 40% of global wealth.

Source - America's External Balances Economic outlook

'America, America, God shed his grace on thee,

And crown thy good with brotherhood,

From sea to shining sea...'

Thursday, July 27, 2006

Greed (Gordon Gekko)

The point is, ladies and gentleman, that greed -- for lack of a better word -- is good.

Greed is right.

Greed works.

Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms -- greed for life, for money, for love, knowledge -- has marked the upward surge of mankind.

And greed -- you mark my words -- will not only save Teldar Paper, but that other malfunctioning corporation called the USA.

Thank you very much

Greed is right.

Greed works.

Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms -- greed for life, for money, for love, knowledge -- has marked the upward surge of mankind.

And greed -- you mark my words -- will not only save Teldar Paper, but that other malfunctioning corporation called the USA.

Thank you very much

Labels:

brokerage,

gordon gekko,

greed,

oliver stone,

stock,

stocks,

Wall Street

Wednesday, July 26, 2006

Monday, July 24, 2006

Wal-Mart's New Online Children's 'Hub' a Real Bomb

Wal)Mart's new online Children's Hub is Real Bomb. That has blown inside WlaMart. It contains blogs for teens, and contains following copyright's "best practice":Shopping will be my number ONE hobby this fall. I am going to be the most fashionable teen at school! I'll be on the lookout for the latest fashions. From leggings to layers, to boots and flats, big belts and headbands! I'll be looking for it all! Layering is SO IN right now. Hobo bags are also in style. OH! And big sunglasses! WHOO!! I don't know where to stop! With all of the new clothes I'll be getting, the kids at school will be begging me for fashion tips!

(this is post from Holly - a child actress with grown-up ghostwriters)

Garfield's Ad Review

(this is post from Holly - a child actress with grown-up ghostwriters)

Garfield's Ad Review

Sunday, July 23, 2006

Saturday, July 22, 2006

Friday, July 21, 2006

Thursday, July 20, 2006

Business

If a business was a human beign, brand would be its personality, its soul.

Advertising (communication) is it's appearance, discourse.

Its suppliers is its meal - they're filling it with energy neccesary to produce customers.

Customers are its children - because the 'purpose of the business is to create customer' (Peter F. Drucker), it is the sacred goal of the business - create and serve by the means of business processes, educate through advertising its kids - CUSTOMERS.

Advertising (communication) is it's appearance, discourse.

Its suppliers is its meal - they're filling it with energy neccesary to produce customers.

Customers are its children - because the 'purpose of the business is to create customer' (Peter F. Drucker), it is the sacred goal of the business - create and serve by the means of business processes, educate through advertising its kids - CUSTOMERS.

Dollar Drops Back as Bernanke Looks Forward

Fed Chairman Bernanke’s testimony sounded off a message largely similar to the June 29 FOMC statement by echoing a less ambiguous outlook on a moderating economic activity, while maintaining vigilance against inflation.

The Fed faces the existing threat of rising inflation and the gradually approaching threat of a slowing economy. Since the more urgent threat is underlined by actual inflation rather than slowing growth, the Fed will have to (and likely) deliver the appropriate policy measure to tackle the more pressing threat by raising the fed funds rates to 5.50% next month.

Raising interest rates 17 times and pausing in August in the face of rising inflation and $77-$80 oil is akin to taking a long journey by foot to a train station without eventually taking getting on the train. Making a pause in August, followed by renewed hike in fall would not only trigger fresh questions on the credibility and competency of the Fed, but also would make an additional rate hike less welcoming by the financial markets than in the scenario of an August rate hike.

We view the FX market reaction of shedding more than a cent off the dollar against the European currencies and a full yen against the Japanese currency as an overreaction. FX and bond markets largely focused on Bernanke’s stating the obvious, namely:” The FOMC projections… anticipate slightly lower growth in real output”, which may imply that the Fed is near the end.

But the testimony shows no signs of deprioritizing inflation. The Fed raised its core PCE price index projection for the rest of the year to 2.25%-2.50% from February’s 1.75%-2.00%. Bearing in mind that Bernanke’s testimony does reflect this morning’s 4th consecutive monthly 0.3% reading in core CPI -- the highest year- on -year core CPI reading since January 2002, the Chairman is apt to keep the door open for an August 25-bp rate hike, which we expect to be pursued.

Indeed, the testimony devoted more ink to moderating growth and the likelihood of further cooling when stating the:” the lags between policy actions and their effects”. But the recent slowing in US data does not suggest an urgency of economic contraction, as the existing urgency of rising oil prices and inflation is currently embedded in the latest data. In fact, the retreat in the June headline CPI to 0.2% from 0.4% in May and the unchanged 0.3% in the core figure reflected a 0.9% decline in energy prices in June following a 2.4% increase in May. It is possible that by August 8th, the Fed would have made its own preliminary estimates for the July CPI, which will be largely a function of oil prices in the remainder of the month.

June FOMC Minutes may be past info but revealing and relevant.

Thursday’s release of the minutes from the June FOMC meeting may bear less significance following today’s more current testimony. Nevertheless, we expect the market greater attention to these minutes as they supply us with a wider range regarding the breadth of policymakers’ thinking, rather than Bernanke’s more central delivery, whose media exposure limits it from shedding the level of detail that can be found in the minutes.

FX Outlook

The Fed’s projections for lower GDP growth in the second half of the year and for lower core PCE price index next year (following a possible run-up in the second half of the current year) should start weighing on the US dollar by offsetting the risk of uncertainty for an August hike. Aside from the Treasury-bound safe haven flows helping the greenback, the dollar shall remain with a favorable cost of carry that could make medium term carry trades a risky enterprise. In addition, there has been no real correlation between slowing US economy and a falling dollar.

Instead, the more pressing sources of dollar downside emerge from not only rising chances of an August pause, but also the extent to which markets believe that an August rate hike would be the last. This latter point could especially emerge if next week’s release of home sales figures (existing and new) finally show a unanimous decline, and a tepid July payrolls report is accompanied by a retreat in the average hourly earnings. Equally important, is the August 1st release of the June core PCE price index and whether it will post 2.1% for the third straight month.

As for the market message, despite the continued 5-6 bp yield inversion in favor of 2-year yields over 10-year yields, the 10-year yield remains 20 bps below the fed funds rate, suggesting that any further rate hikes may be untenable.

The markets’ forward looking emphasis on moderating growth and post-August Fed is likely to more than offset any positive dollar dynamics that may occur from continued escalation in the Mideast. We expect the euro to carry upward support at the 1.25 figure, with preliminary target at 1.2750 by month-end. We expect USDJPY to retreat towards its 200 day MA of 116, with support building up at 115.25-30 by month-end. Only an actual outright yuan revaluation by the PBOC (odds at 50% in Q3) would breach the 115 and onto 114.50.

(Source: Forexnews.com )

The Fed faces the existing threat of rising inflation and the gradually approaching threat of a slowing economy. Since the more urgent threat is underlined by actual inflation rather than slowing growth, the Fed will have to (and likely) deliver the appropriate policy measure to tackle the more pressing threat by raising the fed funds rates to 5.50% next month.

Raising interest rates 17 times and pausing in August in the face of rising inflation and $77-$80 oil is akin to taking a long journey by foot to a train station without eventually taking getting on the train. Making a pause in August, followed by renewed hike in fall would not only trigger fresh questions on the credibility and competency of the Fed, but also would make an additional rate hike less welcoming by the financial markets than in the scenario of an August rate hike.

We view the FX market reaction of shedding more than a cent off the dollar against the European currencies and a full yen against the Japanese currency as an overreaction. FX and bond markets largely focused on Bernanke’s stating the obvious, namely:” The FOMC projections… anticipate slightly lower growth in real output”, which may imply that the Fed is near the end.

But the testimony shows no signs of deprioritizing inflation. The Fed raised its core PCE price index projection for the rest of the year to 2.25%-2.50% from February’s 1.75%-2.00%. Bearing in mind that Bernanke’s testimony does reflect this morning’s 4th consecutive monthly 0.3% reading in core CPI -- the highest year- on -year core CPI reading since January 2002, the Chairman is apt to keep the door open for an August 25-bp rate hike, which we expect to be pursued.

Indeed, the testimony devoted more ink to moderating growth and the likelihood of further cooling when stating the:” the lags between policy actions and their effects”. But the recent slowing in US data does not suggest an urgency of economic contraction, as the existing urgency of rising oil prices and inflation is currently embedded in the latest data. In fact, the retreat in the June headline CPI to 0.2% from 0.4% in May and the unchanged 0.3% in the core figure reflected a 0.9% decline in energy prices in June following a 2.4% increase in May. It is possible that by August 8th, the Fed would have made its own preliminary estimates for the July CPI, which will be largely a function of oil prices in the remainder of the month.

June FOMC Minutes may be past info but revealing and relevant.

Thursday’s release of the minutes from the June FOMC meeting may bear less significance following today’s more current testimony. Nevertheless, we expect the market greater attention to these minutes as they supply us with a wider range regarding the breadth of policymakers’ thinking, rather than Bernanke’s more central delivery, whose media exposure limits it from shedding the level of detail that can be found in the minutes.

FX Outlook

The Fed’s projections for lower GDP growth in the second half of the year and for lower core PCE price index next year (following a possible run-up in the second half of the current year) should start weighing on the US dollar by offsetting the risk of uncertainty for an August hike. Aside from the Treasury-bound safe haven flows helping the greenback, the dollar shall remain with a favorable cost of carry that could make medium term carry trades a risky enterprise. In addition, there has been no real correlation between slowing US economy and a falling dollar.

Instead, the more pressing sources of dollar downside emerge from not only rising chances of an August pause, but also the extent to which markets believe that an August rate hike would be the last. This latter point could especially emerge if next week’s release of home sales figures (existing and new) finally show a unanimous decline, and a tepid July payrolls report is accompanied by a retreat in the average hourly earnings. Equally important, is the August 1st release of the June core PCE price index and whether it will post 2.1% for the third straight month.

As for the market message, despite the continued 5-6 bp yield inversion in favor of 2-year yields over 10-year yields, the 10-year yield remains 20 bps below the fed funds rate, suggesting that any further rate hikes may be untenable.

The markets’ forward looking emphasis on moderating growth and post-August Fed is likely to more than offset any positive dollar dynamics that may occur from continued escalation in the Mideast. We expect the euro to carry upward support at the 1.25 figure, with preliminary target at 1.2750 by month-end. We expect USDJPY to retreat towards its 200 day MA of 116, with support building up at 115.25-30 by month-end. Only an actual outright yuan revaluation by the PBOC (odds at 50% in Q3) would breach the 115 and onto 114.50.

(Source: Forexnews.com )

BUSINESS CYCLE

Boom and bust. The long-run pattern of economic GROWTH and RECESSION. According to the Centre for International Business Cycle Research at Columbia University, between 1854 and 1945 the average expansion lasted 29 months and the average contraction 21 months. Since the second world war, however, expansions have lasted almost twice as long, an average of 50 months, and contractions have shortened to an average of only 11 months. Over the years, economists have produced numerous theories of why economic activity fluctuates so much, none of them particularly convincing. A Kitchin cycle supposedly lasted 39 months and was due to fluctuations in companies' inventories. The Juglar cycle would last 8—9 years as a result of changes in INVESTMENT in plant and machinery. Then there was the 20-year Kuznets cycle, allegedly driven by house-building, and, perhaps the best-known theory of them all, the 50-year kondratieff wave. HAYEK tangled with KEYNES over what caused the business cycle, and won the NOBEL PRIZE FOR ECONOMICS for his theory that variations in an economy's OUTPUT depended on the sort of capital it had. Taking a quite different tack, in the late 1960s Arthur Okun, an economic adviser to presidents Kennedy and Johnson, proclaimed that the business cycle was "obsolete". A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and GLOBALISATION meant that the business cycle was a thing of the past. Alas, they were soon proved wrong.

Source - The Economist

Source - The Economist

E-commerce

Jul 10th 2006

From Economist.com

When the technology bubble burst in 2000, the crazy valuations for online companies vanished with it, and many e-tailers folded or were gobbled up by bigger, old-economy fish. Yet after some lean years the survivors are looking forward to a bright future. The internet has profoundly changed consumer behaviour and online retail sales and advertising revenues are rising fast. Internet-based auctions have been a runaway success and it seems most travel bookings will move online within the decade. After a discouraging start, online entertainment also seems to have got its act together. The one big disappointment has been business-to-business exchanges, which have been slow to take off. Yet there have also been surprises: searching for profit, epitomised by Google, has become a highly competitive industry. And many of the retailers who are poised to do best are the old-economy “big box” stores, which the internet was supposed to clobber. As e-commerce celebrated its tenth birthday in 2005, there were some clear lessons on what makes an e-business succeed.

From Economist.com

When the technology bubble burst in 2000, the crazy valuations for online companies vanished with it, and many e-tailers folded or were gobbled up by bigger, old-economy fish. Yet after some lean years the survivors are looking forward to a bright future. The internet has profoundly changed consumer behaviour and online retail sales and advertising revenues are rising fast. Internet-based auctions have been a runaway success and it seems most travel bookings will move online within the decade. After a discouraging start, online entertainment also seems to have got its act together. The one big disappointment has been business-to-business exchanges, which have been slow to take off. Yet there have also been surprises: searching for profit, epitomised by Google, has become a highly competitive industry. And many of the retailers who are poised to do best are the old-economy “big box” stores, which the internet was supposed to clobber. As e-commerce celebrated its tenth birthday in 2005, there were some clear lessons on what makes an e-business succeed.

Wednesday, July 19, 2006

Branding

Brand advertising is inherently about leaving an impression on a consumer, and thus about some sort of exposure.

TO ILC or not to ILC?

There is a great fight over Wal Mart's application to get a banking license and form ILC (Industial Loan Company). BY US law it is prohibited to companies that derive more than 15% of its profits from non-financial business to own ILC.

What is pro and cons (in brief - all that follows source The Economist)

According to those against non-banks owning ILCs, mixing banking and commerce could distort lending. A non-bank owner could use its banking subsidiary's deposits (which, through the FDIC, are insured by the taxpayer) as a source of cheap finance. In particular, suppose that the parent company got into trouble. It might borrow from the ILC to shore itself up. Alternatively, the ILC's customers could take fright at the parent's difficulties and pull out their deposits in a hurry. What, ask the bill's supporters, would have happened had Enron owned a bank?

Others think these fears overblown. In America's competitive financial industry, a bank's ability to discriminate in its lending is limited. Moreover, federal rules that limit the amount banks can lend to their affiliates are already on the books.

Those who see no reason why non-banks should not own ILCs say bankers' real fear is competition, especially from Wal-Mart and Home Depot. Although Wal-Mart insists it would use an ILC only to save money on processing its credit-card and debit-card transactions, bankers fear it will eventually enter branch banking. Already, the retailer cashes cheques, sends money orders and so forth, often much more cheaply than competitors do. In Massachusetts bankers are fighting Wal-Mart's attempts to start cashing cheques in the state. And the customers? Too bad.

What is pro and cons (in brief - all that follows source The Economist)

According to those against non-banks owning ILCs, mixing banking and commerce could distort lending. A non-bank owner could use its banking subsidiary's deposits (which, through the FDIC, are insured by the taxpayer) as a source of cheap finance. In particular, suppose that the parent company got into trouble. It might borrow from the ILC to shore itself up. Alternatively, the ILC's customers could take fright at the parent's difficulties and pull out their deposits in a hurry. What, ask the bill's supporters, would have happened had Enron owned a bank?

Others think these fears overblown. In America's competitive financial industry, a bank's ability to discriminate in its lending is limited. Moreover, federal rules that limit the amount banks can lend to their affiliates are already on the books.

Those who see no reason why non-banks should not own ILCs say bankers' real fear is competition, especially from Wal-Mart and Home Depot. Although Wal-Mart insists it would use an ILC only to save money on processing its credit-card and debit-card transactions, bankers fear it will eventually enter branch banking. Already, the retailer cashes cheques, sends money orders and so forth, often much more cheaply than competitors do. In Massachusetts bankers are fighting Wal-Mart's attempts to start cashing cheques in the state. And the customers? Too bad.

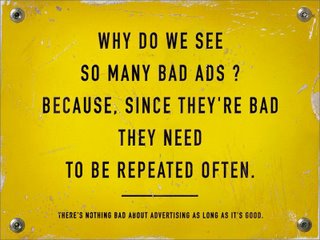

ADVERTISING

Many firms advertise their goods or services, but are they wasting economic resources? Some economists reckon that advertising merely manipulates consumer tastes and creates desires that would not otherwise exist. By increasing product differentiation and encouraging BRAND loyalty advertising may make consumers less price sensitive, moving the market further from PERFECT COMPETITION towards imperfect competition (see MONOPOLISTIC COMPETITION) and increasing the ability of firms to charge more than marginal cost. Heavy spending on advertising may also create a barrier to entry, as a firm entering the market would have to spend a lot on advertising too.

However, some economists argue that advertising is economically valuable because it increases the flow of information in the economy and reduces the asymmetric information between the seller and the consumer. This intensifies competition, as consumers can be made aware quickly when there is a better deal on offer.

By The Economist

However, some economists argue that advertising is economically valuable because it increases the flow of information in the economy and reduces the asymmetric information between the seller and the consumer. This intensifies competition, as consumers can be made aware quickly when there is a better deal on offer.

By The Economist

What is Money Laundering?

Money laundering occurs when funds from an illegal/criminal activity are moved through the financial system in such a way as to make it appear that the funds have come from legitimate sources, according to the National Futures Association. Money Laundering usually follows three stages. First, cash or cash equivalents are placed into the financial system. Second, money is transferred or moved to other accounts (e.g. futures accounts) through a series of financial transactions designed to obscure the origin of the money (e.g. executing trades with little or no financial risk or transferring account balances to other accounts). Finally, the funds are reintroduced into the economy so that the funds appear to have come from legitimate sources (e.g. closing a futures account and transferring the funds to a bank account). Trading accounts that are carried by FCMs (Forex Capital Manager) are one vehicle that can be used to launder illicit funds or to hide the true owner of the funds. In particular, a trading account could be used to execute financial transactions that help obscure the origins of the funds.

US DOLLAR INDEX - 'Double bottom brightens the outlook'

by Mike Ellis

6/13/2006, Forexnews.com

Analysis

The Dollar Index made two lunges down into the 83's over the past month and neither one quite met the full 83.10 projection from the large head and shoulders formed over much of the past year. However, in the aftermath of warding off these two dips, the Dollar has staged a more aggressive comeback to break loose over the 85.50 resistance, thereby developing a modest double bottom. While the size of the latest base is nothing to compare against that prior top structure, the speed of the decline out of the 89's formed little in the way of resistance en route and so there appears to be a fairly clear road back up to 87.80. So the greenback may well have rounded the corner here because, even though it is likely to be denied in that 87.80 vicinity on the first couple of approaches, resulting setbacks would probably be contained in the 85's to develop an overall upward stepping process, the culmination of which could later be the conquest of 87.80. Therefore, barring being slapped back below 85.00, the technical scene has evolved positively for the US currency and strategy could accordingly become more aggressive.

6/13/2006, Forexnews.com

Analysis

The Dollar Index made two lunges down into the 83's over the past month and neither one quite met the full 83.10 projection from the large head and shoulders formed over much of the past year. However, in the aftermath of warding off these two dips, the Dollar has staged a more aggressive comeback to break loose over the 85.50 resistance, thereby developing a modest double bottom. While the size of the latest base is nothing to compare against that prior top structure, the speed of the decline out of the 89's formed little in the way of resistance en route and so there appears to be a fairly clear road back up to 87.80. So the greenback may well have rounded the corner here because, even though it is likely to be denied in that 87.80 vicinity on the first couple of approaches, resulting setbacks would probably be contained in the 85's to develop an overall upward stepping process, the culmination of which could later be the conquest of 87.80. Therefore, barring being slapped back below 85.00, the technical scene has evolved positively for the US currency and strategy could accordingly become more aggressive.

Tuesday, July 18, 2006

Statistical thinking

Statistical thinking is a philosophy of learning and action based on folllowing three principles:

- All work occurs on system of interconnected processes

- Variation exists in all processes

- Understanding and reducing variation are keys to success

'Statistical Thinking', ASQ Statistics Division Newsletter (Spring 1999),3

Monday, July 17, 2006

Global marketing

Global marketing refers to marketing activities of companies

that emphasize four activities: (1 ) cost efficiencies

resulting from reduced duplication of efforts; (2) opportunities

to transfer products, brands, and ideas across subsidiaries

in different countries; (3) emergence of global

customers, such as global teenagers or the global elite;

and (4) better links between national marketing infrastructures,

which paves the way for a global marketing infrastructure

that results in better management and reduced

costs.

that emphasize four activities: (1 ) cost efficiencies

resulting from reduced duplication of efforts; (2) opportunities

to transfer products, brands, and ideas across subsidiaries

in different countries; (3) emergence of global

customers, such as global teenagers or the global elite;

and (4) better links between national marketing infrastructures,

which paves the way for a global marketing infrastructure

that results in better management and reduced

costs.

Sunday, July 16, 2006

BBC NEWS | Business | G8 deadline on Doha trade talks

Leaders of the G8 nations meeting in St Petersburg have set a one month deadline for World Trade Organization (WTO) members to revive stalled talks.

BBC NEWS Business G8 deadline on Doha trade talks

BBC NEWS Business G8 deadline on Doha trade talks

The Economist Big Mac index

FXBigMac - World economics based on the hamburger standard

Interesting tool for Purchasing Power Parity (PPP) measurement introduced by The Economist

Interesting tool for Purchasing Power Parity (PPP) measurement introduced by The Economist

What trust is?

I prefer the following definition of trust as “the ability to deliver on implicit or explicit statements and to execute the activity in a manner that the client wants it to be and is promised.”

Subscribe to:

Comments (Atom)