Expectations govern markets. Only the media can make money from yesterday. Money is made in markets by people acting today in expectation of what will happen in the future, or in fulfillment of what had been expected and acted upon previously. Changing expectations change markets.

In details

Monday, July 31, 2006

Sunday, July 30, 2006

Trade diplomacy and internal politics

The trade diplomat's incantation that to open his market is a “concession” granted in exchange for an opening somewhere else is economic nonsense spouted for domestic political purpose.

But it is remarkably fruitful nonsense because, within the World Trade Organisation, any concession to one trade partner is automatically extended to all members. This trick has helped the world enjoy decades of prosperity.

(Source The Economist)

But it is remarkably fruitful nonsense because, within the World Trade Organisation, any concession to one trade partner is automatically extended to all members. This trick has helped the world enjoy decades of prosperity.

(Source The Economist)

Supply concerns push oil and copper higher

Oil prices continued to rise on Friday, extending their gains from the previous session, amid continuing concerns about fighting in the Middle East and the possibility of prolonged disruption in to output from Nigeria.

In Nigeria, Shell has declared force majeure on Bonny Light crude exports from a terminal that normally exports about 390,000 barrels of oil a day after a pipeline leak shut down 180,00 barrels a day of production.

Shell’s chief executive warned there was unlikely to be a significant recovery this year in the production that has been shut down.

ICE September Brent rose 20 cents to $75.21 a barrel while Nymex September West Texas Intermediate added 10 cents to $74.64 a barrel.

Copper rose to $7,620 a tonne on supply concerns with workers at Escondida, the world’s largest copper mine in Chile, likely to vote for strike action later on Friday.

Click here for more from FT.com

Source Yahoo! Finance

In Nigeria, Shell has declared force majeure on Bonny Light crude exports from a terminal that normally exports about 390,000 barrels of oil a day after a pipeline leak shut down 180,00 barrels a day of production.

Shell’s chief executive warned there was unlikely to be a significant recovery this year in the production that has been shut down.

ICE September Brent rose 20 cents to $75.21 a barrel while Nymex September West Texas Intermediate added 10 cents to $74.64 a barrel.

Copper rose to $7,620 a tonne on supply concerns with workers at Escondida, the world’s largest copper mine in Chile, likely to vote for strike action later on Friday.

Click here for more from FT.com

Source Yahoo! Finance

Saturday, July 29, 2006

Friday, July 28, 2006

Where the wealth is?

The level of gross foreign claims on U.S. assets is approaching $14 trillion, about 25 percent of U.S. wealth and perhaps 10 percent of global wealth. Eventually, foreign investors would become reluctant to own, say, the bulk of U.S. assets or to have the majority of their wealth holdings invested in one country. However, we are far from such limits for two reasons.

Followign that logic, the USA is home for the 40% of global wealth.

Source - America's External Balances Economic outlook

'America, America, God shed his grace on thee,

And crown thy good with brotherhood,

From sea to shining sea...'

Followign that logic, the USA is home for the 40% of global wealth.

Source - America's External Balances Economic outlook

'America, America, God shed his grace on thee,

And crown thy good with brotherhood,

From sea to shining sea...'

Thursday, July 27, 2006

Greed (Gordon Gekko)

The point is, ladies and gentleman, that greed -- for lack of a better word -- is good.

Greed is right.

Greed works.

Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms -- greed for life, for money, for love, knowledge -- has marked the upward surge of mankind.

And greed -- you mark my words -- will not only save Teldar Paper, but that other malfunctioning corporation called the USA.

Thank you very much

Greed is right.

Greed works.

Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms -- greed for life, for money, for love, knowledge -- has marked the upward surge of mankind.

And greed -- you mark my words -- will not only save Teldar Paper, but that other malfunctioning corporation called the USA.

Thank you very much

Labels:

brokerage,

gordon gekko,

greed,

oliver stone,

stock,

stocks,

Wall Street

Wednesday, July 26, 2006

Monday, July 24, 2006

Wal-Mart's New Online Children's 'Hub' a Real Bomb

Wal)Mart's new online Children's Hub is Real Bomb. That has blown inside WlaMart. It contains blogs for teens, and contains following copyright's "best practice":Shopping will be my number ONE hobby this fall. I am going to be the most fashionable teen at school! I'll be on the lookout for the latest fashions. From leggings to layers, to boots and flats, big belts and headbands! I'll be looking for it all! Layering is SO IN right now. Hobo bags are also in style. OH! And big sunglasses! WHOO!! I don't know where to stop! With all of the new clothes I'll be getting, the kids at school will be begging me for fashion tips!

(this is post from Holly - a child actress with grown-up ghostwriters)

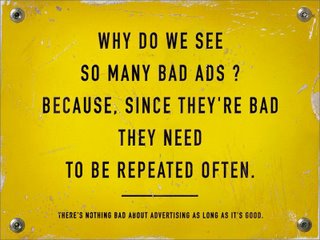

Garfield's Ad Review

(this is post from Holly - a child actress with grown-up ghostwriters)

Garfield's Ad Review

Sunday, July 23, 2006

Saturday, July 22, 2006

Friday, July 21, 2006

Thursday, July 20, 2006

Business

If a business was a human beign, brand would be its personality, its soul.

Advertising (communication) is it's appearance, discourse.

Its suppliers is its meal - they're filling it with energy neccesary to produce customers.

Customers are its children - because the 'purpose of the business is to create customer' (Peter F. Drucker), it is the sacred goal of the business - create and serve by the means of business processes, educate through advertising its kids - CUSTOMERS.

Advertising (communication) is it's appearance, discourse.

Its suppliers is its meal - they're filling it with energy neccesary to produce customers.

Customers are its children - because the 'purpose of the business is to create customer' (Peter F. Drucker), it is the sacred goal of the business - create and serve by the means of business processes, educate through advertising its kids - CUSTOMERS.

Dollar Drops Back as Bernanke Looks Forward

Fed Chairman Bernanke’s testimony sounded off a message largely similar to the June 29 FOMC statement by echoing a less ambiguous outlook on a moderating economic activity, while maintaining vigilance against inflation.

The Fed faces the existing threat of rising inflation and the gradually approaching threat of a slowing economy. Since the more urgent threat is underlined by actual inflation rather than slowing growth, the Fed will have to (and likely) deliver the appropriate policy measure to tackle the more pressing threat by raising the fed funds rates to 5.50% next month.

Raising interest rates 17 times and pausing in August in the face of rising inflation and $77-$80 oil is akin to taking a long journey by foot to a train station without eventually taking getting on the train. Making a pause in August, followed by renewed hike in fall would not only trigger fresh questions on the credibility and competency of the Fed, but also would make an additional rate hike less welcoming by the financial markets than in the scenario of an August rate hike.

We view the FX market reaction of shedding more than a cent off the dollar against the European currencies and a full yen against the Japanese currency as an overreaction. FX and bond markets largely focused on Bernanke’s stating the obvious, namely:” The FOMC projections… anticipate slightly lower growth in real output”, which may imply that the Fed is near the end.

But the testimony shows no signs of deprioritizing inflation. The Fed raised its core PCE price index projection for the rest of the year to 2.25%-2.50% from February’s 1.75%-2.00%. Bearing in mind that Bernanke’s testimony does reflect this morning’s 4th consecutive monthly 0.3% reading in core CPI -- the highest year- on -year core CPI reading since January 2002, the Chairman is apt to keep the door open for an August 25-bp rate hike, which we expect to be pursued.

Indeed, the testimony devoted more ink to moderating growth and the likelihood of further cooling when stating the:” the lags between policy actions and their effects”. But the recent slowing in US data does not suggest an urgency of economic contraction, as the existing urgency of rising oil prices and inflation is currently embedded in the latest data. In fact, the retreat in the June headline CPI to 0.2% from 0.4% in May and the unchanged 0.3% in the core figure reflected a 0.9% decline in energy prices in June following a 2.4% increase in May. It is possible that by August 8th, the Fed would have made its own preliminary estimates for the July CPI, which will be largely a function of oil prices in the remainder of the month.

June FOMC Minutes may be past info but revealing and relevant.

Thursday’s release of the minutes from the June FOMC meeting may bear less significance following today’s more current testimony. Nevertheless, we expect the market greater attention to these minutes as they supply us with a wider range regarding the breadth of policymakers’ thinking, rather than Bernanke’s more central delivery, whose media exposure limits it from shedding the level of detail that can be found in the minutes.

FX Outlook

The Fed’s projections for lower GDP growth in the second half of the year and for lower core PCE price index next year (following a possible run-up in the second half of the current year) should start weighing on the US dollar by offsetting the risk of uncertainty for an August hike. Aside from the Treasury-bound safe haven flows helping the greenback, the dollar shall remain with a favorable cost of carry that could make medium term carry trades a risky enterprise. In addition, there has been no real correlation between slowing US economy and a falling dollar.

Instead, the more pressing sources of dollar downside emerge from not only rising chances of an August pause, but also the extent to which markets believe that an August rate hike would be the last. This latter point could especially emerge if next week’s release of home sales figures (existing and new) finally show a unanimous decline, and a tepid July payrolls report is accompanied by a retreat in the average hourly earnings. Equally important, is the August 1st release of the June core PCE price index and whether it will post 2.1% for the third straight month.

As for the market message, despite the continued 5-6 bp yield inversion in favor of 2-year yields over 10-year yields, the 10-year yield remains 20 bps below the fed funds rate, suggesting that any further rate hikes may be untenable.

The markets’ forward looking emphasis on moderating growth and post-August Fed is likely to more than offset any positive dollar dynamics that may occur from continued escalation in the Mideast. We expect the euro to carry upward support at the 1.25 figure, with preliminary target at 1.2750 by month-end. We expect USDJPY to retreat towards its 200 day MA of 116, with support building up at 115.25-30 by month-end. Only an actual outright yuan revaluation by the PBOC (odds at 50% in Q3) would breach the 115 and onto 114.50.

(Source: Forexnews.com )

The Fed faces the existing threat of rising inflation and the gradually approaching threat of a slowing economy. Since the more urgent threat is underlined by actual inflation rather than slowing growth, the Fed will have to (and likely) deliver the appropriate policy measure to tackle the more pressing threat by raising the fed funds rates to 5.50% next month.

Raising interest rates 17 times and pausing in August in the face of rising inflation and $77-$80 oil is akin to taking a long journey by foot to a train station without eventually taking getting on the train. Making a pause in August, followed by renewed hike in fall would not only trigger fresh questions on the credibility and competency of the Fed, but also would make an additional rate hike less welcoming by the financial markets than in the scenario of an August rate hike.

We view the FX market reaction of shedding more than a cent off the dollar against the European currencies and a full yen against the Japanese currency as an overreaction. FX and bond markets largely focused on Bernanke’s stating the obvious, namely:” The FOMC projections… anticipate slightly lower growth in real output”, which may imply that the Fed is near the end.

But the testimony shows no signs of deprioritizing inflation. The Fed raised its core PCE price index projection for the rest of the year to 2.25%-2.50% from February’s 1.75%-2.00%. Bearing in mind that Bernanke’s testimony does reflect this morning’s 4th consecutive monthly 0.3% reading in core CPI -- the highest year- on -year core CPI reading since January 2002, the Chairman is apt to keep the door open for an August 25-bp rate hike, which we expect to be pursued.

Indeed, the testimony devoted more ink to moderating growth and the likelihood of further cooling when stating the:” the lags between policy actions and their effects”. But the recent slowing in US data does not suggest an urgency of economic contraction, as the existing urgency of rising oil prices and inflation is currently embedded in the latest data. In fact, the retreat in the June headline CPI to 0.2% from 0.4% in May and the unchanged 0.3% in the core figure reflected a 0.9% decline in energy prices in June following a 2.4% increase in May. It is possible that by August 8th, the Fed would have made its own preliminary estimates for the July CPI, which will be largely a function of oil prices in the remainder of the month.

June FOMC Minutes may be past info but revealing and relevant.

Thursday’s release of the minutes from the June FOMC meeting may bear less significance following today’s more current testimony. Nevertheless, we expect the market greater attention to these minutes as they supply us with a wider range regarding the breadth of policymakers’ thinking, rather than Bernanke’s more central delivery, whose media exposure limits it from shedding the level of detail that can be found in the minutes.

FX Outlook

The Fed’s projections for lower GDP growth in the second half of the year and for lower core PCE price index next year (following a possible run-up in the second half of the current year) should start weighing on the US dollar by offsetting the risk of uncertainty for an August hike. Aside from the Treasury-bound safe haven flows helping the greenback, the dollar shall remain with a favorable cost of carry that could make medium term carry trades a risky enterprise. In addition, there has been no real correlation between slowing US economy and a falling dollar.

Instead, the more pressing sources of dollar downside emerge from not only rising chances of an August pause, but also the extent to which markets believe that an August rate hike would be the last. This latter point could especially emerge if next week’s release of home sales figures (existing and new) finally show a unanimous decline, and a tepid July payrolls report is accompanied by a retreat in the average hourly earnings. Equally important, is the August 1st release of the June core PCE price index and whether it will post 2.1% for the third straight month.

As for the market message, despite the continued 5-6 bp yield inversion in favor of 2-year yields over 10-year yields, the 10-year yield remains 20 bps below the fed funds rate, suggesting that any further rate hikes may be untenable.

The markets’ forward looking emphasis on moderating growth and post-August Fed is likely to more than offset any positive dollar dynamics that may occur from continued escalation in the Mideast. We expect the euro to carry upward support at the 1.25 figure, with preliminary target at 1.2750 by month-end. We expect USDJPY to retreat towards its 200 day MA of 116, with support building up at 115.25-30 by month-end. Only an actual outright yuan revaluation by the PBOC (odds at 50% in Q3) would breach the 115 and onto 114.50.

(Source: Forexnews.com )

BUSINESS CYCLE

Boom and bust. The long-run pattern of economic GROWTH and RECESSION. According to the Centre for International Business Cycle Research at Columbia University, between 1854 and 1945 the average expansion lasted 29 months and the average contraction 21 months. Since the second world war, however, expansions have lasted almost twice as long, an average of 50 months, and contractions have shortened to an average of only 11 months. Over the years, economists have produced numerous theories of why economic activity fluctuates so much, none of them particularly convincing. A Kitchin cycle supposedly lasted 39 months and was due to fluctuations in companies' inventories. The Juglar cycle would last 8—9 years as a result of changes in INVESTMENT in plant and machinery. Then there was the 20-year Kuznets cycle, allegedly driven by house-building, and, perhaps the best-known theory of them all, the 50-year kondratieff wave. HAYEK tangled with KEYNES over what caused the business cycle, and won the NOBEL PRIZE FOR ECONOMICS for his theory that variations in an economy's OUTPUT depended on the sort of capital it had. Taking a quite different tack, in the late 1960s Arthur Okun, an economic adviser to presidents Kennedy and Johnson, proclaimed that the business cycle was "obsolete". A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and GLOBALISATION meant that the business cycle was a thing of the past. Alas, they were soon proved wrong.

Source - The Economist

Source - The Economist

E-commerce

Jul 10th 2006

From Economist.com

When the technology bubble burst in 2000, the crazy valuations for online companies vanished with it, and many e-tailers folded or were gobbled up by bigger, old-economy fish. Yet after some lean years the survivors are looking forward to a bright future. The internet has profoundly changed consumer behaviour and online retail sales and advertising revenues are rising fast. Internet-based auctions have been a runaway success and it seems most travel bookings will move online within the decade. After a discouraging start, online entertainment also seems to have got its act together. The one big disappointment has been business-to-business exchanges, which have been slow to take off. Yet there have also been surprises: searching for profit, epitomised by Google, has become a highly competitive industry. And many of the retailers who are poised to do best are the old-economy “big box” stores, which the internet was supposed to clobber. As e-commerce celebrated its tenth birthday in 2005, there were some clear lessons on what makes an e-business succeed.

From Economist.com

When the technology bubble burst in 2000, the crazy valuations for online companies vanished with it, and many e-tailers folded or were gobbled up by bigger, old-economy fish. Yet after some lean years the survivors are looking forward to a bright future. The internet has profoundly changed consumer behaviour and online retail sales and advertising revenues are rising fast. Internet-based auctions have been a runaway success and it seems most travel bookings will move online within the decade. After a discouraging start, online entertainment also seems to have got its act together. The one big disappointment has been business-to-business exchanges, which have been slow to take off. Yet there have also been surprises: searching for profit, epitomised by Google, has become a highly competitive industry. And many of the retailers who are poised to do best are the old-economy “big box” stores, which the internet was supposed to clobber. As e-commerce celebrated its tenth birthday in 2005, there were some clear lessons on what makes an e-business succeed.

Wednesday, July 19, 2006

Branding

Brand advertising is inherently about leaving an impression on a consumer, and thus about some sort of exposure.

TO ILC or not to ILC?

There is a great fight over Wal Mart's application to get a banking license and form ILC (Industial Loan Company). BY US law it is prohibited to companies that derive more than 15% of its profits from non-financial business to own ILC.

What is pro and cons (in brief - all that follows source The Economist)

According to those against non-banks owning ILCs, mixing banking and commerce could distort lending. A non-bank owner could use its banking subsidiary's deposits (which, through the FDIC, are insured by the taxpayer) as a source of cheap finance. In particular, suppose that the parent company got into trouble. It might borrow from the ILC to shore itself up. Alternatively, the ILC's customers could take fright at the parent's difficulties and pull out their deposits in a hurry. What, ask the bill's supporters, would have happened had Enron owned a bank?

Others think these fears overblown. In America's competitive financial industry, a bank's ability to discriminate in its lending is limited. Moreover, federal rules that limit the amount banks can lend to their affiliates are already on the books.

Those who see no reason why non-banks should not own ILCs say bankers' real fear is competition, especially from Wal-Mart and Home Depot. Although Wal-Mart insists it would use an ILC only to save money on processing its credit-card and debit-card transactions, bankers fear it will eventually enter branch banking. Already, the retailer cashes cheques, sends money orders and so forth, often much more cheaply than competitors do. In Massachusetts bankers are fighting Wal-Mart's attempts to start cashing cheques in the state. And the customers? Too bad.

What is pro and cons (in brief - all that follows source The Economist)

According to those against non-banks owning ILCs, mixing banking and commerce could distort lending. A non-bank owner could use its banking subsidiary's deposits (which, through the FDIC, are insured by the taxpayer) as a source of cheap finance. In particular, suppose that the parent company got into trouble. It might borrow from the ILC to shore itself up. Alternatively, the ILC's customers could take fright at the parent's difficulties and pull out their deposits in a hurry. What, ask the bill's supporters, would have happened had Enron owned a bank?

Others think these fears overblown. In America's competitive financial industry, a bank's ability to discriminate in its lending is limited. Moreover, federal rules that limit the amount banks can lend to their affiliates are already on the books.

Those who see no reason why non-banks should not own ILCs say bankers' real fear is competition, especially from Wal-Mart and Home Depot. Although Wal-Mart insists it would use an ILC only to save money on processing its credit-card and debit-card transactions, bankers fear it will eventually enter branch banking. Already, the retailer cashes cheques, sends money orders and so forth, often much more cheaply than competitors do. In Massachusetts bankers are fighting Wal-Mart's attempts to start cashing cheques in the state. And the customers? Too bad.

ADVERTISING

Many firms advertise their goods or services, but are they wasting economic resources? Some economists reckon that advertising merely manipulates consumer tastes and creates desires that would not otherwise exist. By increasing product differentiation and encouraging BRAND loyalty advertising may make consumers less price sensitive, moving the market further from PERFECT COMPETITION towards imperfect competition (see MONOPOLISTIC COMPETITION) and increasing the ability of firms to charge more than marginal cost. Heavy spending on advertising may also create a barrier to entry, as a firm entering the market would have to spend a lot on advertising too.

However, some economists argue that advertising is economically valuable because it increases the flow of information in the economy and reduces the asymmetric information between the seller and the consumer. This intensifies competition, as consumers can be made aware quickly when there is a better deal on offer.

By The Economist

However, some economists argue that advertising is economically valuable because it increases the flow of information in the economy and reduces the asymmetric information between the seller and the consumer. This intensifies competition, as consumers can be made aware quickly when there is a better deal on offer.

By The Economist

What is Money Laundering?

Money laundering occurs when funds from an illegal/criminal activity are moved through the financial system in such a way as to make it appear that the funds have come from legitimate sources, according to the National Futures Association. Money Laundering usually follows three stages. First, cash or cash equivalents are placed into the financial system. Second, money is transferred or moved to other accounts (e.g. futures accounts) through a series of financial transactions designed to obscure the origin of the money (e.g. executing trades with little or no financial risk or transferring account balances to other accounts). Finally, the funds are reintroduced into the economy so that the funds appear to have come from legitimate sources (e.g. closing a futures account and transferring the funds to a bank account). Trading accounts that are carried by FCMs (Forex Capital Manager) are one vehicle that can be used to launder illicit funds or to hide the true owner of the funds. In particular, a trading account could be used to execute financial transactions that help obscure the origins of the funds.

US DOLLAR INDEX - 'Double bottom brightens the outlook'

by Mike Ellis

6/13/2006, Forexnews.com

Analysis

The Dollar Index made two lunges down into the 83's over the past month and neither one quite met the full 83.10 projection from the large head and shoulders formed over much of the past year. However, in the aftermath of warding off these two dips, the Dollar has staged a more aggressive comeback to break loose over the 85.50 resistance, thereby developing a modest double bottom. While the size of the latest base is nothing to compare against that prior top structure, the speed of the decline out of the 89's formed little in the way of resistance en route and so there appears to be a fairly clear road back up to 87.80. So the greenback may well have rounded the corner here because, even though it is likely to be denied in that 87.80 vicinity on the first couple of approaches, resulting setbacks would probably be contained in the 85's to develop an overall upward stepping process, the culmination of which could later be the conquest of 87.80. Therefore, barring being slapped back below 85.00, the technical scene has evolved positively for the US currency and strategy could accordingly become more aggressive.

6/13/2006, Forexnews.com

Analysis

The Dollar Index made two lunges down into the 83's over the past month and neither one quite met the full 83.10 projection from the large head and shoulders formed over much of the past year. However, in the aftermath of warding off these two dips, the Dollar has staged a more aggressive comeback to break loose over the 85.50 resistance, thereby developing a modest double bottom. While the size of the latest base is nothing to compare against that prior top structure, the speed of the decline out of the 89's formed little in the way of resistance en route and so there appears to be a fairly clear road back up to 87.80. So the greenback may well have rounded the corner here because, even though it is likely to be denied in that 87.80 vicinity on the first couple of approaches, resulting setbacks would probably be contained in the 85's to develop an overall upward stepping process, the culmination of which could later be the conquest of 87.80. Therefore, barring being slapped back below 85.00, the technical scene has evolved positively for the US currency and strategy could accordingly become more aggressive.

Tuesday, July 18, 2006

Statistical thinking

Statistical thinking is a philosophy of learning and action based on folllowing three principles:

- All work occurs on system of interconnected processes

- Variation exists in all processes

- Understanding and reducing variation are keys to success

'Statistical Thinking', ASQ Statistics Division Newsletter (Spring 1999),3

Monday, July 17, 2006

Global marketing

Global marketing refers to marketing activities of companies

that emphasize four activities: (1 ) cost efficiencies

resulting from reduced duplication of efforts; (2) opportunities

to transfer products, brands, and ideas across subsidiaries

in different countries; (3) emergence of global

customers, such as global teenagers or the global elite;

and (4) better links between national marketing infrastructures,

which paves the way for a global marketing infrastructure

that results in better management and reduced

costs.

that emphasize four activities: (1 ) cost efficiencies

resulting from reduced duplication of efforts; (2) opportunities

to transfer products, brands, and ideas across subsidiaries

in different countries; (3) emergence of global

customers, such as global teenagers or the global elite;

and (4) better links between national marketing infrastructures,

which paves the way for a global marketing infrastructure

that results in better management and reduced

costs.

Sunday, July 16, 2006

BBC NEWS | Business | G8 deadline on Doha trade talks

Leaders of the G8 nations meeting in St Petersburg have set a one month deadline for World Trade Organization (WTO) members to revive stalled talks.

BBC NEWS Business G8 deadline on Doha trade talks

BBC NEWS Business G8 deadline on Doha trade talks

The Economist Big Mac index

FXBigMac - World economics based on the hamburger standard

Interesting tool for Purchasing Power Parity (PPP) measurement introduced by The Economist

Interesting tool for Purchasing Power Parity (PPP) measurement introduced by The Economist

What trust is?

I prefer the following definition of trust as “the ability to deliver on implicit or explicit statements and to execute the activity in a manner that the client wants it to be and is promised.”

Subscribe to:

Posts (Atom)